Vanilla Gift Card Corporate Rewards Programs Transform Employee Recognition in 2026

Corporate rewards and employee recognition programs have undergone a dramatic shift in recent years, with traditional approaches like plaques, branded merchandise, and company dinners giving way to more flexible and universally appreciated incentives. At the forefront of this transformation are Vanilla Visa gift cards, which have emerged as one of the most popular tools for businesses looking to reward their teams in meaningful and practical ways.

The Rise of Gift Cards in Corporate Incentive Programs

The corporate gift card market has expanded rapidly as human resources departments and business leaders recognize the limitations of one-size-fits-all rewards. Industry research indicates that the corporate and B2B gift card segment now represents a substantial portion of total gift card sales in North America, with growth rates consistently outpacing the consumer segment.

Vanilla Visa gift cards are particularly well-suited for corporate programs because they function as open-loop prepaid cards accepted everywhere Visa is accepted. Unlike store-specific cards that force recipients to shop at a particular retailer, Vanilla Visa cards give employees the freedom to spend their reward however they choose. This flexibility has proven to be the single most important factor in recipient satisfaction with corporate reward programs.

Why Businesses Choose Vanilla Visa for Employee Recognition

Several practical advantages make Vanilla Visa gift cards the preferred choice for corporate buyers. The cards are available in a wide range of denominations, allowing companies to calibrate their rewards based on achievement levels, milestones, or budget constraints. A business might offer twenty-five dollar cards for monthly performance spotlights and two-hundred dollar cards for annual excellence awards, all using the same trusted product.

Bulk purchasing options provide significant cost savings for companies running large-scale programs. Corporate accounts with Vanilla's parent company InComm Payments often include reduced activation fees, dedicated account management, and customized branding options that allow businesses to feature their company logo on the card itself. These personalization features transform a simple prepaid card into a branded recognition tool that reinforces company identity.

The administrative simplicity of gift card programs also appeals to busy HR teams. Compared to managing merchandise catalogs, coordinating experience-based rewards, or processing cash bonuses through payroll, distributing prepaid gift cards requires minimal logistics and can be executed almost instantly through digital delivery channels.

Digital Delivery and Instant Gratification

The shift toward digital Vanilla Visa gift cards has accelerated the adoption of prepaid rewards in corporate settings. Companies can now send electronic gift cards directly to employee email inboxes within minutes of a recognition event, eliminating the delays associated with physical card shipping and distribution.

This instant delivery capability is especially valuable for remote and distributed workforces, which have become the norm for many organizations. A manager in New York can recognize an outstanding contribution from a team member in Austin or London with the same speed and ease, ensuring that recognition feels timely and sincere regardless of geographic distance.

Digital delivery also creates a documented trail that simplifies program tracking and reporting. HR departments can monitor when cards are sent, to whom, for what reason, and at what value, providing the data needed to evaluate program effectiveness and justify ongoing investment in recognition initiatives.

Tax Considerations for Corporate Gift Card Programs

Businesses implementing Vanilla Visa gift card reward programs should be aware of the tax implications for both the company and the recipients. In the United States, gift cards provided to employees are generally considered taxable income and must be reported accordingly. The IRS treats gift cards as cash equivalents, which means their value should be included in the employee's W-2 earnings.

Companies typically handle this by grossing up the gift card value to cover the tax burden, ensuring that the employee receives the full intended reward amount after taxes. While this adds a layer of complexity and cost to the program, the positive impact on employee morale and retention typically far outweighs the additional administrative requirements.

Working with a knowledgeable payroll provider or tax advisor ensures compliance with all reporting obligations and helps companies structure their programs in the most tax-efficient manner possible.

Measuring the ROI of Gift Card Reward Programs

Forward-thinking organizations are increasingly focused on quantifying the return on investment from their employee recognition programs. Key metrics tracked by companies using Vanilla Visa gift card programs include employee engagement scores, voluntary turnover rates, productivity indicators, and program participation levels.

Research from multiple workforce studies has consistently shown that organizations with strong recognition cultures experience lower turnover and higher engagement compared to those without formal recognition programs. While isolating the specific impact of gift card rewards from other engagement factors is challenging, the correlation between systematic recognition and positive workforce outcomes is well established.

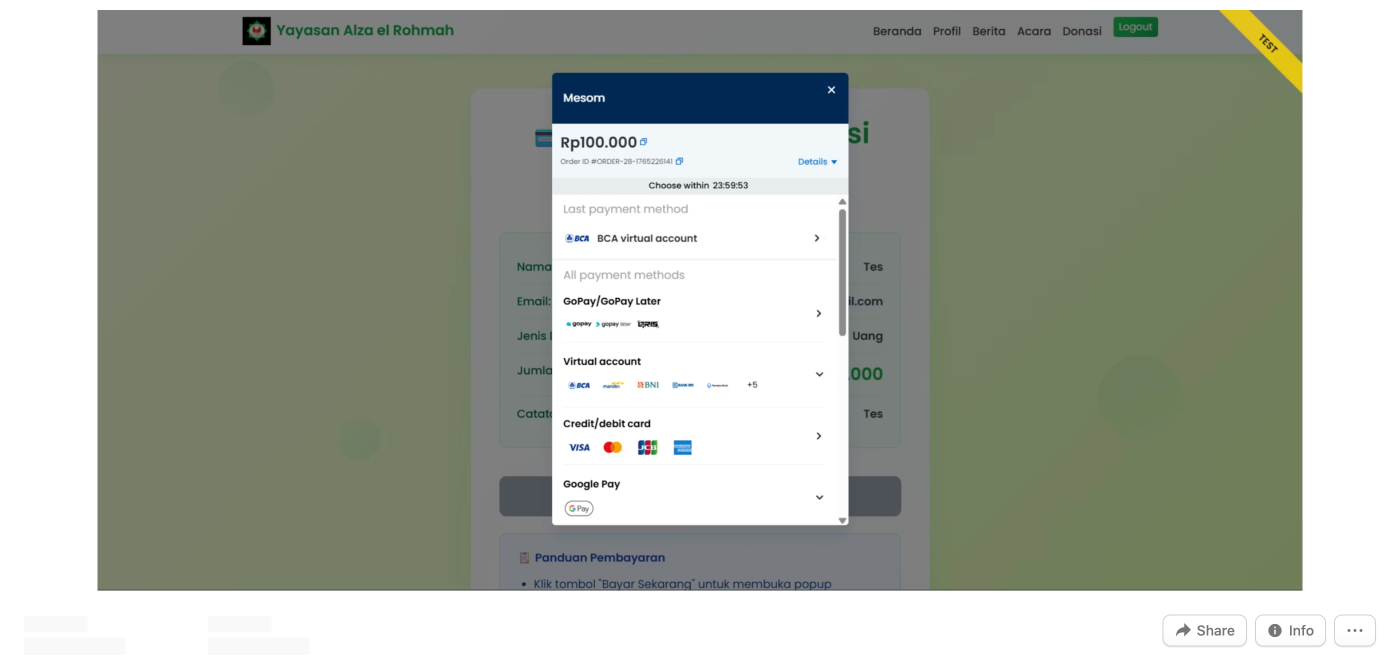

Platforms like INWISH contribute to the broader gift card ecosystem by providing trading and exchange services that ensure gift card value is never wasted. Employees who receive prepaid cards they cannot immediately use have options for converting that value into preferred alternatives, further reinforcing the practical utility of gift card-based recognition programs.

Best Practices for Corporate Gift Card Programs

Successful corporate gift card programs share several common characteristics that distinguish them from underperforming initiatives. Consistency in recognition is crucial, as sporadic or unpredictable rewards create less impact than regular and expected acknowledgments tied to clear criteria.

Personalization beyond the card itself also matters. Pairing a Vanilla Visa gift card with a handwritten note from a manager or a public acknowledgment during a team meeting transforms a financial reward into a genuine expression of appreciation. The monetary value of the card reinforces the emotional message, creating a more memorable and motivating experience for the recipient.

Setting clear program guidelines that define eligibility criteria, award levels, and the behaviors or achievements being recognized ensures fairness and transparency. Employees who understand what earns recognition are more likely to align their efforts with organizational priorities, creating a positive feedback loop that benefits both the individual and the company.

Final Thoughts

Vanilla Visa gift cards have established themselves as a cornerstone of modern corporate rewards and employee recognition strategies. Their universal acceptance, flexible denomination options, and digital delivery capabilities make them an ideal fit for organizations of all sizes looking to invest in workforce engagement. As platforms like INWISH continue to expand the gift card ecosystem with trading and exchange services, the practical value of prepaid Visa cards in corporate programs will only continue to grow, providing businesses with a proven tool for building a more motivated and loyal workforce.

Ready to Trade Gift Cards?

Join thousands of users who trust Inwish for safe and convenient gift card trading.

Related Articles

February 11, 2026

How to Sell Gift Cards Online: The Definitive Selling Guide for Maximum Profit

February 11, 2026

Razer Gold: The Complete Guide to Gaming's Universal Digital Currency

February 11, 2026

Razer Gift Cards: The Gamer's Guide to Premium Peripherals and Smart Digital Shopping

February 11, 2026

PUBG UC: How to Buy, Use, and Trade Unknown Cash for the Best Gaming Experience

February 11, 2026

Paysafe Cards Explained: How to Use Paysafecard for Secure Online Transactions and Gift Card Trading

February 11, 2026