Visa Gift Card Fees Explained: What Every Buyer Should Know in 2026

Visa gift cards are among the most widely purchased prepaid products in the United States, with billions of dollars loaded onto these cards each year. While they offer the convenience of a universal payment method accepted virtually everywhere, many buyers are surprised to discover the various fees that can gradually reduce the card's usable value. Understanding these charges before making a purchase is essential for anyone looking to give or use a Visa gift card wisely.

The Activation Fee: Your First Cost

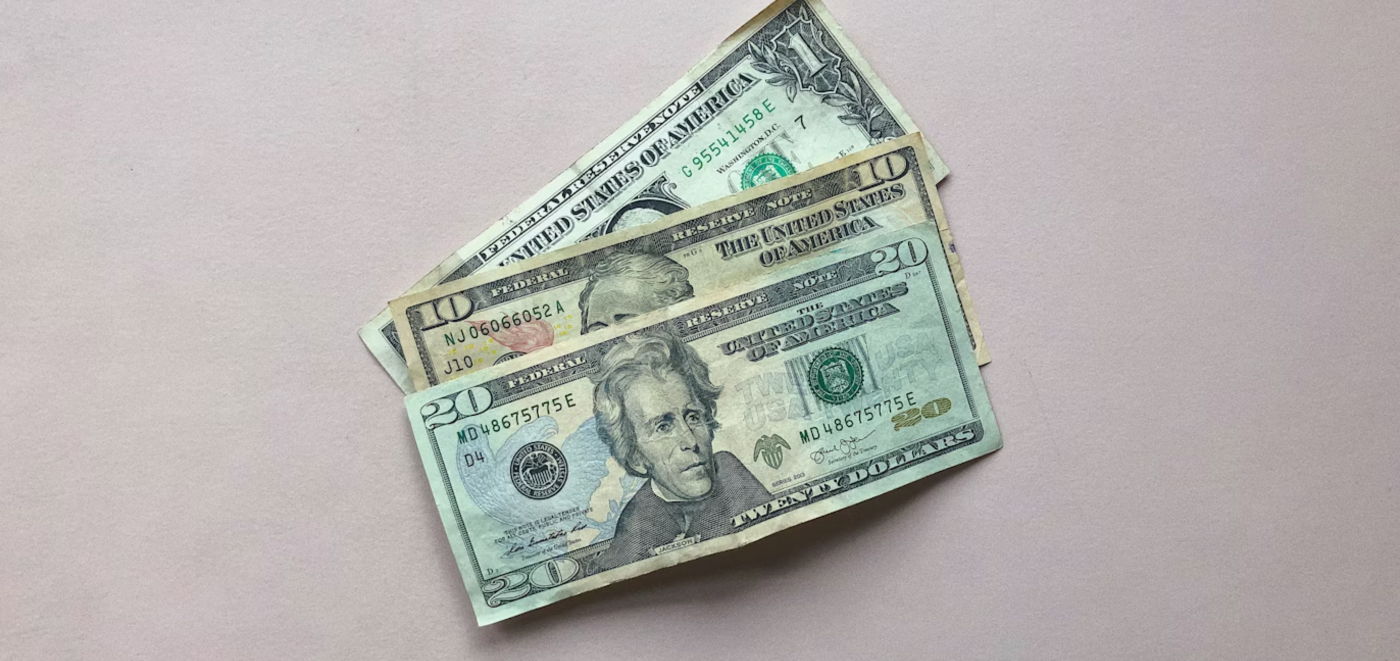

Every Visa gift card sold at retail locations comes with an activation fee, sometimes called a purchase fee. This charge ranges from approximately three to seven dollars depending on the card denomination and the retailer selling it. A twenty-five dollar Visa gift card might carry a four dollar activation fee, meaning the buyer actually pays twenty-nine dollars at the register while the card holds only twenty-five dollars in spending power.

The activation fee covers the costs associated with card production, distribution, and the payment network processing infrastructure. While this fee is unavoidable at most physical retail locations, some promotions and corporate programs occasionally waive it. Buyers purchasing cards during major holidays should watch for special deals where retailers absorb the activation cost as a promotional incentive.

Monthly Maintenance and Service Fees

One of the most misunderstood charges associated with Visa gift cards is the monthly maintenance fee. Federal regulations under the Credit CARD Act of 2009 prohibit issuers from charging inactivity or service fees for the first twelve months after a card is purchased. After that initial year, however, issuers may deduct a monthly service fee from the remaining balance.

These monthly fees typically range from two to three dollars and begin automatically once the twelve-month grace period expires. For gift card recipients who forget about a card or set it aside with a small remaining balance, these fees can slowly erode the value to zero. The lesson for cardholders is straightforward: use the full balance within the first year to avoid any maintenance deductions.

Dormancy and Inactivity Penalties

Closely related to maintenance fees, dormancy fees specifically target cards that have not been used for an extended period. While federal law sets the twelve-month minimum before any fees can apply, some state laws provide even stronger protections for consumers. Several states prohibit dormancy fees entirely or extend the fee-free period well beyond the federal requirement.

Cardholders should check the fee schedule printed on the card packaging or available on the issuer website to understand exactly when dormancy charges might begin. The terms and conditions vary significantly between card issuers, making it important to read the fine print before purchasing or accepting a Visa gift card as a gift.

Replacement and Customer Service Fees

Lost or stolen Visa gift cards present another fee scenario that many cardholders do not anticipate. Requesting a replacement card often incurs a fee ranging from five to fifteen dollars, and the process can take several weeks. Some issuers also charge for balance inquiries made through automated phone systems, though checking the balance online is typically free.

Registering the card immediately after purchase and keeping the receipt and card packaging provides essential documentation needed for any replacement claim. Without proof of purchase and the original card number, recovering funds from a lost card becomes significantly more difficult.

Foreign Transaction and Currency Conversion Fees

Using a Visa gift card for international purchases or on foreign websites can trigger currency conversion fees that catch many users off guard. These fees typically amount to two to three percent of the transaction value and are deducted from the card balance in addition to the purchase amount. For a fifty-dollar international purchase, the cardholder might see an additional dollar or more charged to their balance.

Domestic Visa gift cards are generally intended for use within the United States, and their fee structures reflect this. Buyers who plan to use their card for international transactions should consider this additional cost when budgeting their purchases.

How to Minimize Visa Gift Card Fees

Smart buyers have several strategies for reducing the impact of fees on their Visa gift card experience. Purchasing higher denomination cards spreads the fixed activation fee across a larger balance, improving the overall value ratio. A one-hundred dollar card with a six dollar activation fee offers much better value than a twenty-five dollar card with a four dollar fee.

Using the entire balance promptly after purchase eliminates any risk of monthly maintenance or dormancy charges. For cards received as gifts, spending the balance within the first few months ensures maximum value retention. When small balances remain that are difficult to spend in a single transaction, platforms like INWISH offer gift card trading options that help convert remaining value into usable funds rather than letting it erode through fees.

Comparing Fees Across Issuers and Retailers

Not all Visa gift cards carry identical fee structures. Cards sold at grocery stores, pharmacies, and big-box retailers may have different activation fees even for the same denomination. Online gift card retailers sometimes offer lower fees or bundle promotions that reduce the per-card cost for bulk purchases.

Vanilla Visa cards, one of the most popular branded Visa gift card lines, maintain a competitive fee schedule that has helped establish their market dominance. Comparing the fee disclosures on card packaging before purchasing allows buyers to select the most cost-effective option available at their preferred retailer.

Final Thoughts

Visa gift card fees are an unavoidable part of the prepaid card landscape, but informed buyers can significantly reduce their impact through smart purchasing decisions and prompt usage. Understanding the activation fee structure, the twelve-month grace period for maintenance charges, and the potential for dormancy penalties empowers consumers to extract maximum value from every card. As the gift card market continues to grow and platforms like INWISH provide additional options for managing card value, staying informed about fee structures remains a crucial part of being a savvy gift card buyer.

Ready to Trade Gift Cards?

Join thousands of users who trust Inwish for safe and convenient gift card trading.

Related Articles

February 11, 2026

How to Sell Gift Cards Online: The Definitive Selling Guide for Maximum Profit

February 11, 2026

Razer Gold: The Complete Guide to Gaming's Universal Digital Currency

February 11, 2026

Razer Gift Cards: The Gamer's Guide to Premium Peripherals and Smart Digital Shopping

February 11, 2026

PUBG UC: How to Buy, Use, and Trade Unknown Cash for the Best Gaming Experience

February 11, 2026

Paysafe Cards Explained: How to Use Paysafecard for Secure Online Transactions and Gift Card Trading

February 11, 2026